0

0

SHOPPING CART

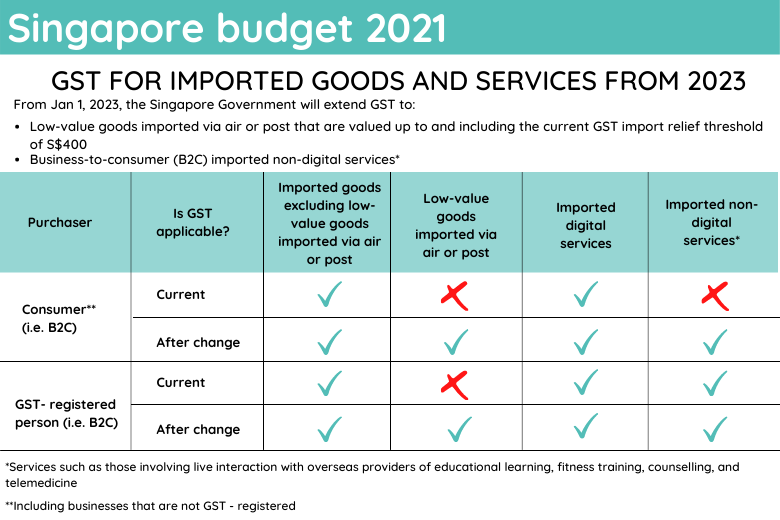

On Feb 16, 2021, Deputy Prime Minister Heng Swee Keat announced that low-value goods bought online and imported via air or post will be subject to Goods and Service Tax (GST).

Currently, imported low-value goods that are worth up to S$400 are not subject to GST to facilitate clearance at the border. However, GST will be imposed on all values of imported goods.

GST will also be imposed on business-to-consumer (B2C) imported non-digital services, which refer to services supplied over the Internet or other electronic networks that require human intervention.

This includes live interactions with overseas providers of educational learning, fitness training, counseling, and telemedicine.

According to Mr. Heng, the changes are one aspect of a fair and resilient tax system, these will ensure a level playing field for domestic businesses and their overseas competitors. This is especially relevant, as e-commerce for sales of goods and services is growing.

Other jurisdictions such as Australia, the European Union, and New Zealand have either implemented or announced similar plans to implement the equivalent of GST on such goods.

The change will take effect from Jan 1, 2023, to allow time for businesses to prepare for implementation, as follows:

Step 1:

It can be inferred that consumers will have to pay the GST when they buy from these overseas suppliers, just as they will be charged when they buy such items from local businesses.

Step 2: Suppliers will collect GST on the sale of low-value goods imported by local consumers, and then pay the GST to IRAS.

Step 3: IRAS will consult the industry before finalizing implementation details.

If you require further assistance with GST Registration in Singapore, feel free to call/WhatsApp us at +65 90612851 or email us at aceglobalacct@gmail.com. Alternatively, you may leave us a reply using our contact form below.

Keep in touch to receive the latest listing, news updates and special offers delivered directly to your inbox.