0

0

SHOPPING CART

Definition of Single Family Office

A Single Family Office (SFO) generally refers to an entity that manages assets for or on behalf of a family, and which is also wholly owned or controlled by the members of that same family.

Depending on the needs of the family, different services are offered, but they typically include:

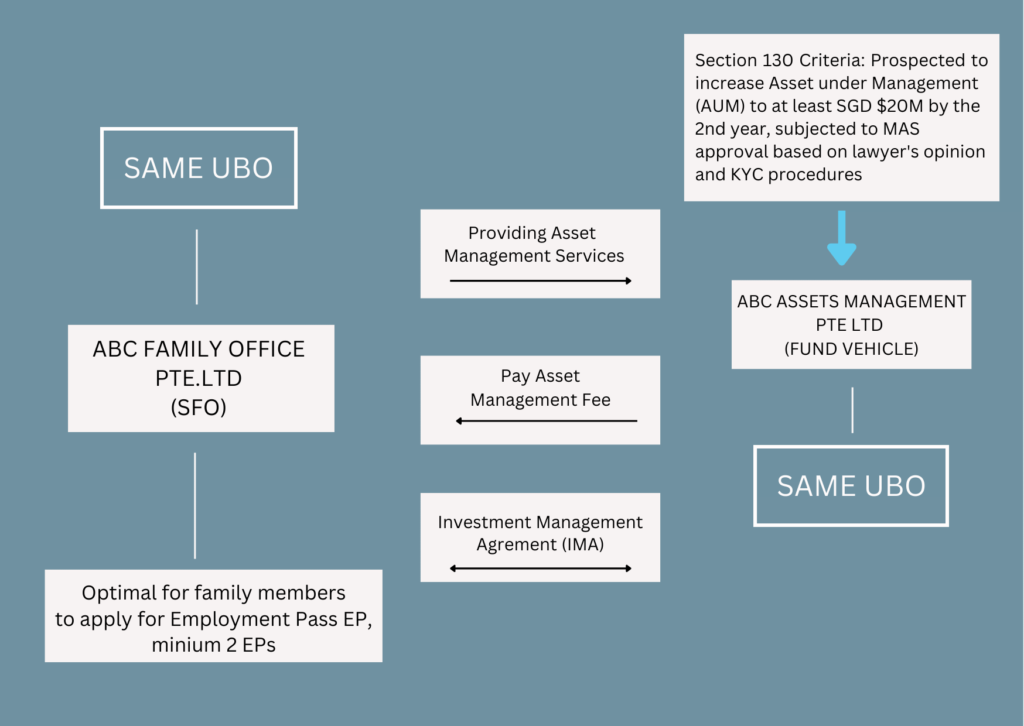

Simplified SFO structure

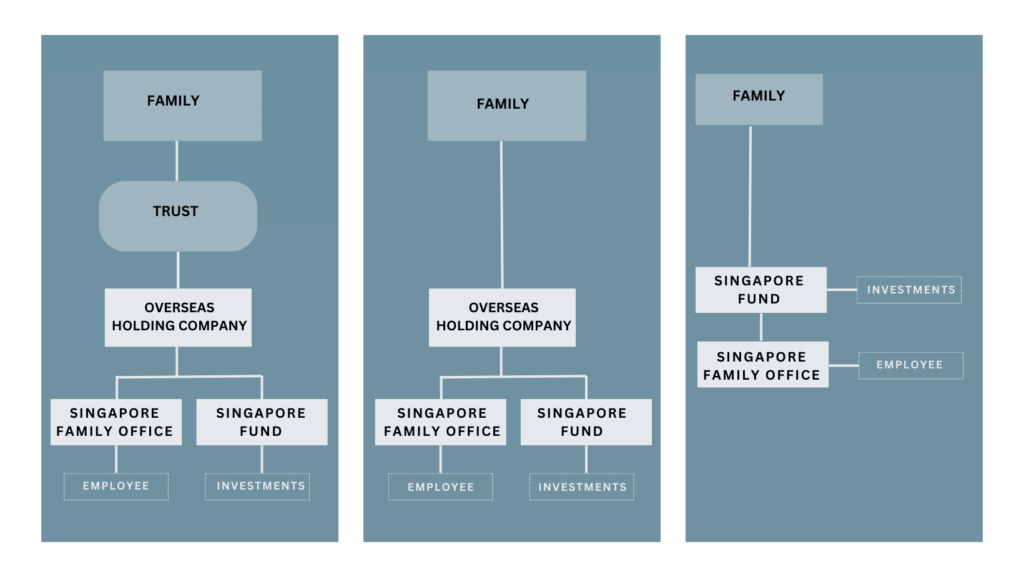

Common SFO structures

Advantages of establishing an SFO in Singapore

Strong ecosystem for the funds industry:

Established network of family offices:

Competitive tax regime:

High standards of living:

Opportunity to obtain residency:

Requirements for licensing for SFOs

The Monetary Authority of Singapore (MAS) regulates fund management activities in Singapore under the Securities and Futures Act (SFA)

Fund managers must:

Tax incentives available to investment funds

Sections 13O and 13U of the Singapore Income Tax Act provide tax exemption for funds managed by Singapore-based fund managers, including SFOs, on Specified Income derived

from Designated Investments.

Designated Investments include stocks, bonds and derivatives, but excludes immovable property in Singapore.

Specified Income refers to any income or gains derived from Designated Investments, except for distributions received from certain trusts and income or gains derived or deemed to be

derived from Singapore from a publicly traded partnership or limited liability company where tax is paid or payable in Singapore on such income by deduction or otherwise.

The MAS administers and approves these schemes. Once granted, the tax exemption status will be valid for the life of the fund, as long as all qualifying conditions are met.

GST remission:

Withholding tax:

Sections 13O and 13U qualifying conditions

For funds managed by Family Offices

| Requirements | 13O Tax Exemption Scheme for Resident Funds | 13U Enhanced-Tier Fund Tax Incentive Scheme |

| Legal Form and Tax Residency | Company incorporated in Singapore or Singapore VCC, tax resident in Singapore | No restrictions |

| Investment Professionals (IPs) | Must employ at least two IPs. A one-year grace period is given to employ the second IP, If it is unable to employ two IPs at the point of application. | Must employ at least three IPs, with at least one IP being a non-family member. A one-year grace period is given, If it is unable to employ one non-family member as an IP at the point of application. |

| Fund Administrator | Singapore-based | Singapore-based if the fund is a Singapore-incorporated and resident company |

| Fund Manager | A family office must manage or advise the fund directly throughout each basis period relating to any Year of Assessment (YA). The family office must be based in Singapore and fulfill the SFO licensing requirements. | |

| Assets Under Management (AUM) |

>S$10 million at the point of application, and the fund commits to increasing its AUM to S$20 million within 2 years. |

>S$50 million at the point of application |

| Business Spending | >S$200,000 in total business spending (TBS) in each basis period relating to any YA, subject to the tiered business spending framework | >S$500,000 in local business spending (LBS) in each basis period relating to any YA, subject to tiered business spending framework |

| Minimum Local Investment3 | The fund must invest at least 10% of its AUM or S$10 million, whichever is lower, in local investments at any one point in time. One-year grace period if the fund is unable to do so by the point of application. |

|

Our Job Scope for Singapore Family Office

Design and structuring phase of new family office structure

Implementation of the proposed structure

FATCA / CRS analysis