0

0

SHOPPING CART

The Competition and Consumer Commission of Singapore (CCCS) just dropped the hammer on two Chinese Yuan remittance companies.

The damage is enormous, with $5.36 million in penalties.

But here’s the thing:

This wasn’t about price fixing or market manipulation in the traditional sense. It was about something far more subtle (and dangerous).

Let our experts at ACE break down exactly what happened, why it matters, and what every Singapore business needs to know to avoid the same fate.

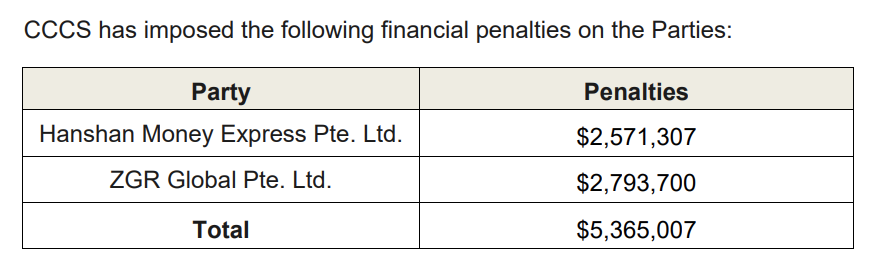

Two remittance giants operating out of People’s Park Complex found themselves in CCCS’s crosshairs:

These aren’t small players. They’re the two leading providers of Chinese Yuan remittance services in one of Singapore’s busiest commercial buildings. And they operate right next to each other.

For over 9 years (starting from at least January 2016), these companies did something that seems almost innocent on the surface:

They shared information. However, not just any information, it is commercially sensitive remittance rate data.

CCCS investigators discovered the companies used three methods to exchange information:

Here’s what made this particularly damaging: The exchanges happened multiple times per day.

Every morning, they’d share their opening rates. Every time one company changed its rates, it would immediately notify the other.

The investigation revealed they exchanged two critical pieces of information:

These actions leave devastating consequences on the Singapore exchange rate market.

Before this illegal coordination, both companies, Hanshan Money Express and ZGR Global, had to:

But once they started sharing information directly, all that competitive uncertainty disappeared.

CCCS found clear evidence that this information sharing led to:

As CCCS Chief Executive Alvin Koh put it:

“By colluding together to exchange such information, the Parties undermined competition in the market for CNY remittance services, which reduced options for customers.”

In addition, CCCS investigators uncovered:

Pattern analysis showing rate convergence during the information-sharing period

WhatsApp messages showing how one company’s staff would immediately update their internal systems after receiving competitor rate information, with captions like “Hanshan’s rates, [which ZGR Global’s] counter has already followed.”

What you may consider legal to do in the business world may, in fact, be illegal.

This case sends a clear message about what crosses the line in competitive intelligence.

The key principle here is that businesses must act independently when making market decisions.

Additionally, CCCS provides clear guidance for businesses approached for anti-competitive information sharing:

| Step-by-step process | What to do |

| Step 1: Publicly distance yourself | Make it clear you’re not interested in such arrangements. |

| Step 2: Report to CCCS | Contact CCCS to report the attempted coordination. |

| If you are already involved |

CCCS offers two lifelines:

|

When you’re unsure whether your company’s actions comply with Singapore law, our experts provide the insights you need to avoid devastating penalties.

At ACE, we specialize in helping businesses navigate Singapore’s complex regulatory landscape, including:

Don’t let uncertainty about legal compliance put your business at risk.

The cost of expert guidance is minimal compared to the millions in fines that can result from violations.

Contact ACE today to ensure your business operations stay on the right side of Singapore law.

If your company needs help filing taxes for the year 2025 or requires assistance with Singapore incorporation, economy, banking, etc., feel free to call /WhatsApp us at +65 90612851 or email us at aceglobalacct@gmail.com. Alternatively, you may leave us a reply using our contact form below.

Keep in touch to receive the latest listing, news updates and special offers delivered directly to your inbox.