0

0

SHOPPING CART

When the Inland Revenue Authority of Singapore (IRAS) investigates false claims, even small discrepancies can lead to serious legal action.

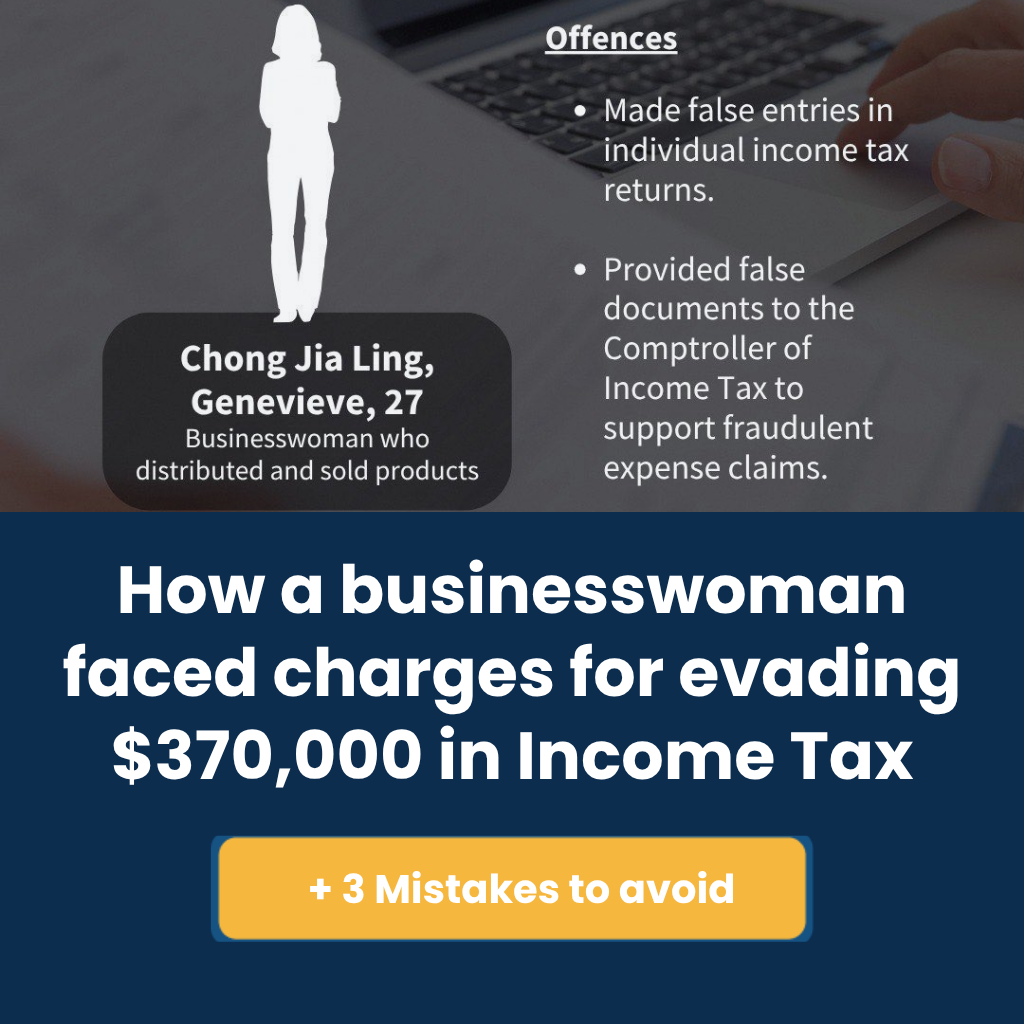

That’s exactly what happened to Chong Jia Ling, Genevieve, a 27-year-old businesswoman who sold and distributed products between 2020 and 2021.

For years, many commission-based agents, especially in the MLM (multi-level marketing) space, assumed that tax audits were something that only happened to “big companies.” After all, they were just individuals earning commissions, often juggling multiple product lines or companies.

But that illusion faded quickly when IRAS began digging deeper.

Between 2020 and 2024, more than 30 MLM agents were audited and investigated for tax anomalies — and several faced serious penalties. One case, in particular, made headlines when an agent was found to have declared only part of her income while claiming questionable expenses.

At first glance, it seemed like a small discrepancy. But when IRAS compared her reported earnings to payment data from MLM platforms, supplier invoices, and bank transactions, the inconsistencies became obvious.

That one case became a cautionary tale for thousands of agents in Singapore.

Here’s the thing: IRAS doesn’t rely on guesswork.

Singapore’s tax authority has become incredibly sophisticated, using data analytics, artificial intelligence, and cross-database matching to identify unusual patterns.

Let’s break it down.

Data Analytics at scale

IRAS collects vast amounts of data — from company filings, CPF contributions, banks, e-commerce platforms, and even payment processors. These data points are compared automatically to detect mismatches.

If, for example, a commission agent reports $60,000 in income but receives $120,000 in commissions from different sources, the system flags it.

Cross-referencing across entities

Many MLM agents set up multiple entities to spread or “shift” income between them. The intention might be to reduce tax liability, but IRAS can easily see through it.

Using entity linkage analysis, auditors trace payments across companies, checking whether these entities have real commercial purposes. If they don’t, the income gets reassessed directly to the agent.

Digital footprints and expense verification

Advanced audit tools help IRAS compare expense claims with transaction data. For example, if an agent claims “marketing costs” of $20,000 but no related business activity is seen, that claim gets questioned.

Even social media and online sales data can be cross-checked to estimate whether declared income matches the scale of operations.

On 24 October 2025, Chong was charged in court for multiple tax evasion offenses, including:

If convicted, she must face

Here’s what typically raises red flags:

Many commission agents don’t report their full gross commission, especially when income comes from multiple sources or downlines.

Some think only “official payments” count, while bonuses or incentives can be left out. That’s a big mistake.

All income, commissions, bonuses, overrides, rewards, must be declared in full. Every dollar counts.

Some agents create several companies to “spread out” their earnings and pay less tax overall. IRAS has explicitly warned that structures without genuine business purposes will be disregarded. When detected, all income is consolidated and taxed under the agent’s name, often with added penalties.

You should only incorporate entities only if they serve a real business function, not just tax reduction.

Agents often overclaim deductions, meals, travel, training sessions, or “bulk purchases” made to reach rank advancement. Unfortunately, those aren’t deductible if they’re not directly related to income generation.

You should only claim expenses that are legitimate, traceable, and clearly tied to earning income. Always keep invoices and receipts.

Audits aren’t meant to scare you — they’re meant to remind you that trust and accuracy form the backbone of Singapore’s tax system.

The commission agent who tried to outsmart the system ended up paying far more in penalties than she ever “saved.”

So if you’re in the same line of work — MLM, real estate, insurance, or affiliate marketing — take this story as a warning, not a threat.

In today’s digital age, every transaction leaves a trail. Make sure yours tells the right story.

If your company needs help filing taxes for the year 2025 or requires assistance with Singapore incorporation, economy, banking, etc., feel free to call /WhatsApp us at +65 90612851 or email us at aceglobalacct@gmail.com. Alternatively, you may leave us a reply using our contact form below.

Keep in touch to receive the latest listing, news updates and special offers delivered directly to your inbox.