0

0

SHOPPING CART

If you’ve ever had a GST claim rejected because of a small invoicing mistake, you know how painful it can be.

Maybe you forgot to include your customer’s GST registration number. Maybe you didn’t issue the invoice within the 30-day limit. Or perhaps, your foreign currency invoice didn’t show the correct conversion to Singapore dollars.

Sounds familiar? You’re not alone.

Many Singapore businesses—especially SMEs—still underestimate how important proper invoicing is. It’s not just paperwork. It’s compliance, cash flow, and credibility all rolled into one.

In this guide, we’ll walk you through exactly how to invoice customers in Singapore the right way, from understanding the types of invoices to avoiding common pitfalls that could get you in trouble with IRAS.

Proper invoicing isn’t just an accounting chore—it’s a compliance safeguard and a trust-building tool.

Here’s a quick recap of what matters most:

If you’ve ever lost hours fixing invoice errors or waiting on delayed payments, you’ve already seen why tax invoices are mission-critical.

In Singapore, a tax invoice isn’t just a receipt. It’s the main document that supports a business’s input tax claim under the Goods and Services Tax (GST) system.

That means:

Without it, your customer can’t claim GST—and you could face compliance penalties during an IRAS audit.

Think of it as the DNA of every transaction. It contains all the details that prove a sale occurred, including the amount of GST charged and who’s responsible for what.

A tax invoice (or customer accounting tax invoice) is a formal document issued when you make a taxable supply to a GST-registered customer.

It includes key information such as your business details, the GST amount, and the type of supply made.

You must:

In short: Tax invoices are the backbone of your GST records, not something you can afford to overlook.

Here’s where things get tricky for many businesses.

You must issue a tax invoice when:

You don’t need to issue a tax invoice when:

However, even for BCRS-related sales, IRAS encourages businesses to include deposits in tax invoices for price transparency. It’s a good practice for building customer trust.

The takeaway?

👉 Always know your customer’s GST registration status before issuing an invoice. It determines the kind of document you need to send.

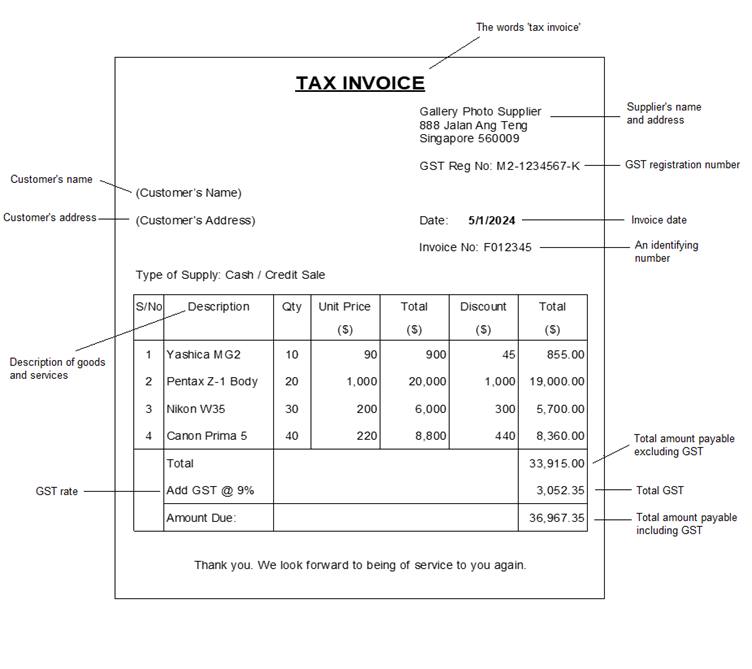

IRAS requires specific information to be included on every tax invoice:

If your invoice involves multiple types of supplies (standard-rated, exempt, or zero-rated), you must separately state the gross amount for each type.

That level of detail isn’t optional—it’s mandatory. Missing or incomplete information could invalidate the document for GST purposes.

Another small but often overlooked detail: rounding.

You can round the total GST on all goods and services to the nearest cent (two decimal places).

If you’re dealing with cash payments, you may also round the total bill (including GST) to the nearest 5 cents—a practical adjustment to facilitate payments.

Whether you choose to round up or down is your business decision. The only rule is: apply it consistently. Inconsistent rounding practices could create mismatched figures between your sales records and GST returns.

Let’s say Urban Brew Café, a small coffee chain in Singapore, sells a latte at $4.68 before GST.

When the café issues an invoice for multiple items, the total GST may be rounded to the nearest cent, and the final bill may be rounded to the nearest 5 cents (e.g., $18.92 → $18.90) to simplify cash handling.

As long as Urban Brew Café applies this method consistently across all transactions, IRAS will consider it compliant.

Here’s a special case:

When you make a relevant supply subject to customer accounting, you must issue a customer accounting tax invoice instead of a regular tax invoice.

This happens for certain prescribed goods, such as:

In these transactions, your GST-registered customer is responsible for accounting for both output and input tax.

That means:

For details on what to include in a customer accounting tax invoice, refer to the official GST: Customer Accounting for Prescribed Goods e-Tax Guide from IRAS.

Not every sale needs a full-blown tax invoice.

If the total payable (including GST) does not exceed $1,000, you can issue a simplified tax invoice instead.

It must include:

Sales vouchers or debit notes can double as simplified tax invoices if they contain all these details. Simplified invoices save time for small-value transactions but still keep your business compliant.

IRAS requires all tax invoices—issued and received—to be kept for at least 5 years.

That means even if you switch software systems, merge with another company, or close your GST account, you must still retain copies for audit purposes.

Digital storage (such as e-invoicing through the Peppol Network) is perfectly acceptable as long as records are complete and retrievable.

Singapore is moving fast toward a fully digital invoicing ecosystem.

Through the Peppol e-invoicing network, businesses can send invoices directly between accounting systems in a secure, structured format recognized by IRAS.

Benefits include:

Invoicing the right way in Singapore isn’t about bureaucracy—it’s about running a professional, compliant business.

A well-structured invoice does more than secure payment; it reflects how seriously you manage your operations. It tells clients you’re reliable, transparent, and audit-ready.

The best part? Once you build a clear system, compliance becomes effortless.

So the next time you send an invoice, don’t just hit “send” or print it right away— make sure it’s GST-perfect. Your accountant, your customers, and IRAS will thank you for it.

If your company needs help filing taxes for the year 2025 or requires assistance with Singapore incorporation, economy, banking, etc., feel free to call /WhatsApp us at +65 90612851 or email us at aceglobalacct@gmail.com. Alternatively, you may leave us a reply using our contact form below.

Keep in touch to receive the latest listing, news updates and special offers delivered directly to your inbox.